Museums both large and small are bequeathed property by families and individuals on a regular basis. The items are either accessioned into the museums’ permanent collections or accepted with the understanding they will be sold at some point to benefit the museum. With regards to the accessioned pieces, the institution is then responsible for the storage, maintenance, and care for the items indefinitely. For items that no longer fit the long term goals of the institution, deaccession is an option in some cases. This process is generally lengthy, and begins with the curator, possibly with the assistance of the Registrar, creating a document called a “Statement of Justification,” which outlines their decision criteria and reasoning for presenting the work as a possible deaccession. In order to determine if a work should be deaccessioned from a museum`s collection, a curator or registrar completes and documents a series of justification steps and then present their findings to the museum director and governing board for final approval.

Deaccessioning is defined as the process by which a work of art or other object is permanently removed from a museum’s collection. Deaccessioning is a practical and constructive tool of collections care that, if practiced thoughtfully, supports the long-term preservation of a collection and can help a museum refine the scope of its collection in order to better serve its mission and community.

The American Alliance of Museums defines deaccession as Deaccessioning is a necessary and appropriate tool in collections management, and a way for a museum to refine its collections. Often times, an object or objects does not fit the organization’s scope of collections, cannot be cared for properly, takes up space needed for other items, or poses a hazard to staff, so it may be considered for deaccessioning. This activity facilitates discussion to determine how well a collections plan and collections management policy help make decisions about deaccessioning. The activity also assesses the appropriateness of deaccessioning and the decision-making process

Selling Deaccessioned Works At Auction

There are many ways and avenues to deaccession property, and an important one is through public auction. An auction environment is usually the best way to sell works from a public institution. It gives the property exposure to a global market, and gives the market an opportunity to purchase an object that is “museum quality” implying it’s of the highest level. Typically the buyers will bid very strongly on works that fit within their collection, and perhaps enhance the collection because of the museum’s provenance for some pieces. The purchase would directly benefit the institution with liquid capital for future acquisitions. In some cases, the institution does not want their identity disclosed to the buying public, but when an auction gallery can use provenance, the reward is generally very positive.

Over the last several decades, Clars Auction Gallery has represented public institutions both large and small, and from coast to coast with very strong results, including the Denver Art Museum, the Hirshhorn Museum and Sculpture Garden (Washington D.C.), Museum of Fine Art Houston, the Fine Arts Museums of San Francisco, among many others.

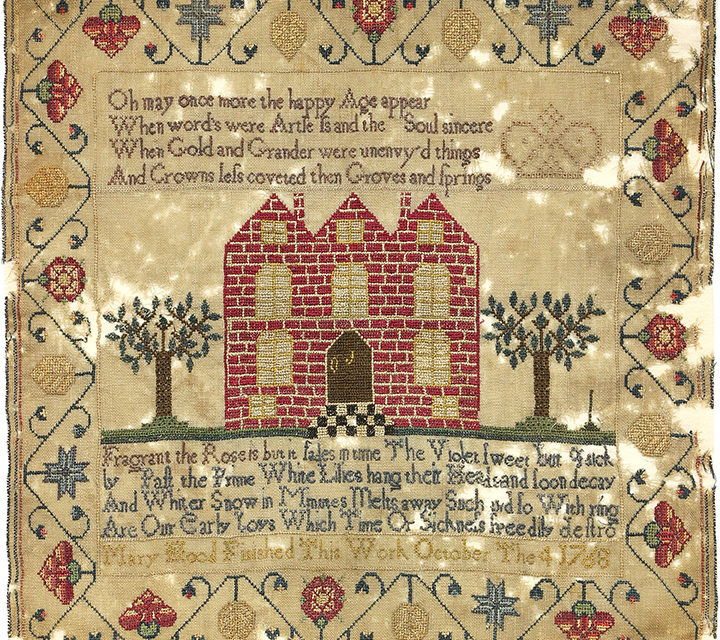

Clars Auction Gallery is proud to have recently been chosen by the Metropolitan Museum of Art, New York, N.Y. (“The Met”) to offer over 700 items from the permanent collection, some of which have been part of the collection for over 110 years. Clars will be offering 17th thru 19th century furniture, English soft paste porcelains, 18th century samplers and decorative art. The initial sale of this fine collection will be February 19, 2017.

The selected items to come to market from the MET and offered at Clars will undoubtedly provide a strong influx of capital for the Institution’s Acquisition Fund. This fund is extremely necessary for the MET to acquire important works for the public to enjoy for decades to come.

In conclusion, Deaccessioning is a necessity for nearly all museums, for which the funds generated help their Acquisition Funds, and can pay off with great dividends.